The Bank of Industry (BOI) has partnered with Iwo community of Osun State to promote use of local fabric in fashion lines.

The Acting Managing Director of the Bank of Industry (BOI), Mr. Waheed Olagunju, who was invited to Iwo by the Oluwo of Iwo said that the Bank Of Industry Limited is ready to assist the fabric makers to expand their business and improve the quality to meet export standard.While inspecting the garments from local fabrics of aso oke and adire, he noted that the over dependence on foreign goods can only be remedied when Nigerians start patronizing locally made goods.

While inspecting the garments from local fabrics of Aso Oke and adire, he noted that theover-dependence on foreign goods can only be remedied when Nigerians start patronizing locally made goods.

The inspection took place at the palace of the Oluwo Of Iwo, Oba Abdul Rasheed Akanbi, Ilufemiloye, Telu 1 in Iwo Local Government of Osun State.

He gave the assurance that he would sign a Memorandum of Understanding that would ensure that all those involved in the value chain are considered to enhance their capacity.

The MoU would also seek to help them add better value to their fabrics in order to make the product a good source of foreign exchange for the country.

The Oluwo of Iwo, Oba Adewale Akanbi, also stated his reason for inviting BOI officials to the town.

He said that he embarked on a campaign to shift attention to usage of local fabrics for western designs to empower those involved in the business and to export Yoruba culture to the outside world.

He explained that the fabric is good enough to be used as uniforms for security agents, uniform for school children among others.

He also disclosed that through his efforts, a bill at the Osun State House of Assembly that makes locally produced adire the uniform for pilgrims from the state to Hajj has been passed.

The monarch urged President Buhari to support the initiative as part of efforts to revive Nigeria’s ailing economy.

Deployment of smart technology in production processes holds the ace in promoting locally made goods in the global market, the Managing Director of the Bank of Industry (BoI), Rasheed Olaoluwa has said.

Deployment of smart technology in production processes holds the ace in promoting locally made goods in the global market, the Managing Director of the Bank of Industry (BoI), Rasheed Olaoluwa has said.

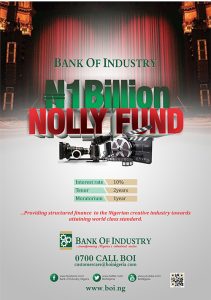

nk of Industry, in line with its cluster-specific approach to SME financing, has launched a N1bn Fashion Fund for female SME operators in the fashion industry. The Fund, according to Mr. Rasheed Olaoluwa, Managing Director/CEO of the Bank, is the third in the series of special SME cluster-focused products that the Bank would be introducing, after the launch of the Cottage Agro Processing (CAP) Fund in 2014, and the launch of the BOI Nolly Fund earlier this year. Speaking at a briefing held at its Lagos Head Office to introduce the Fund, Mr. Olaoluwa pointed out that the Bank was particularly excited about the potentials of the Fund to impact significantly on the Nigerian fashion industry and the entire economy. He explained that BOI’s foray into the fashion industry through this Fund was in order to exploit the enormous opportunities the industry has to create jobs and generally grow the stature of the Nigerian fashion industry within the global fashion industry.

nk of Industry, in line with its cluster-specific approach to SME financing, has launched a N1bn Fashion Fund for female SME operators in the fashion industry. The Fund, according to Mr. Rasheed Olaoluwa, Managing Director/CEO of the Bank, is the third in the series of special SME cluster-focused products that the Bank would be introducing, after the launch of the Cottage Agro Processing (CAP) Fund in 2014, and the launch of the BOI Nolly Fund earlier this year. Speaking at a briefing held at its Lagos Head Office to introduce the Fund, Mr. Olaoluwa pointed out that the Bank was particularly excited about the potentials of the Fund to impact significantly on the Nigerian fashion industry and the entire economy. He explained that BOI’s foray into the fashion industry through this Fund was in order to exploit the enormous opportunities the industry has to create jobs and generally grow the stature of the Nigerian fashion industry within the global fashion industry.

The Bank of Industry (BOI), in its bid to salvage other sector s of the economy in order to improve their contributions towards Nigeria’s GDP, has raise various funds targeted SMEs with the aim of expanding their asset-base to enable them carry on projects of larger scale. The film sector of the entertainment industry is not any less, an emerging sector which contributed 1.42% ($7.3 billion or N1.4 trillion) to Nigeria’s Re-based GDP in 2013.

The Bank of Industry (BOI), in its bid to salvage other sector s of the economy in order to improve their contributions towards Nigeria’s GDP, has raise various funds targeted SMEs with the aim of expanding their asset-base to enable them carry on projects of larger scale. The film sector of the entertainment industry is not any less, an emerging sector which contributed 1.42% ($7.3 billion or N1.4 trillion) to Nigeria’s Re-based GDP in 2013.