Reaffirms commitment to agro-allied sector’s growth

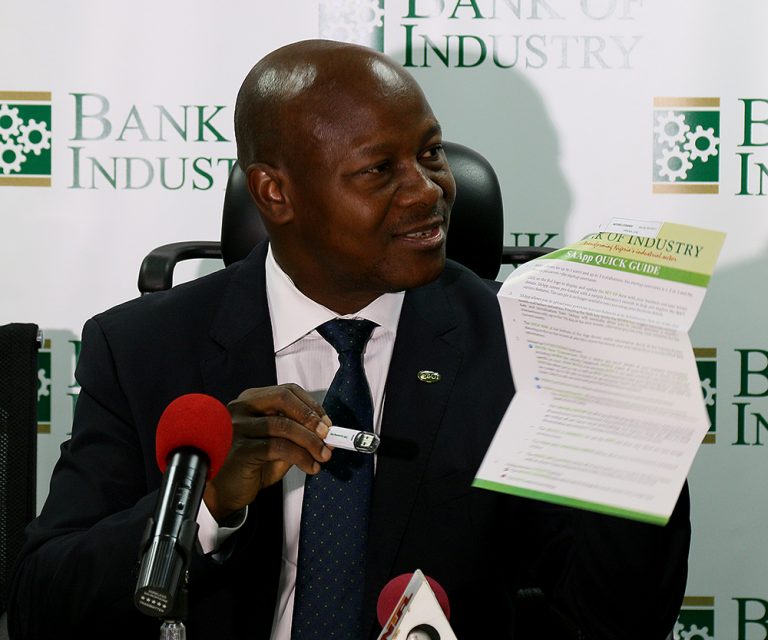

Deployment of smart technology in production processes holds the ace in promoting locally made goods in the global market, the Managing Director of the Bank of Industry (BoI), Rasheed Olaoluwa has said.

Deployment of smart technology in production processes holds the ace in promoting locally made goods in the global market, the Managing Director of the Bank of Industry (BoI), Rasheed Olaoluwa has said.

According to him, olaoluwa also reaffirmed the development finance institution’s commitment to boosting the manufacturing sector of the country through its line of credit and sector-defined intervention fund.

The BoI’s boss, who spoke during a facility tour of Beloxxi Industries Limited, SONA Agro Allied Foods Ltd and Nigerian Foundries Limited (NFL), explained that use of smart technology by manufacturers would aid the competitiveness of respective outputs in terms of cost saving measures and product quality guarantee

He noted that the project visit was to ascertain how the companies had leveraged their operations with increased financing towards boosting production, job creation, value creation and economic growth of the country.

With about N5 billion committed to some of the firms in the agro-allied sector, Olaoluwa emphasised the need for job creation, adding that there is an urgent need to provide employment for the teeming youth population in the country.

He expressed satisfaction at the level of upgrade in production quality, expansion drive, capacity utilisation, warehousing, packaging and staff welfare in the companies.

Olaoluwa said that the fund had positioned the companies to compete with their foreign counterparts and drive industrial growth in the country.

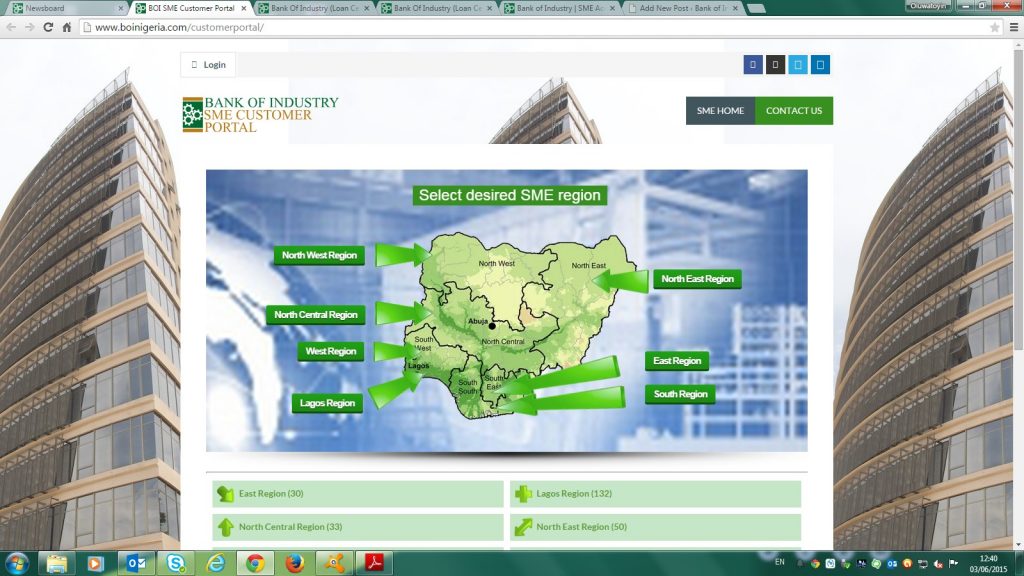

He said that the funding was part of its efforts and commitment at driving the growth of SMEs through its developmental financing platform.

Chief Executive Officer, Beloxxi Industries Limited, Obi Ezeude, said that his company had benefited N4 billion finance from the bank for expansion and upgrading of its facility since forging relationship with the bank in 2010.

He said: “The effort of BoI in lending to MSMEs is gratifying. Our production system has advanced to usage of smart machines and software driven manufacturing.”

Managing Director, Nigerian Foundries Limited, Vassily Barberopoulos, said that the Bank’s fund had increased the capacity utilisation of the company within eight months.

According to him, innovation and expansion from the financing had enhanced the company’s production by additional 1,200 tonnes casting ballast within February to October, which normally ought to have taken one year.

He however emphasised the need to promote local content initiatives in driving the growth of the manufacturing sector.

Olaoluwa urged NFL to leverage using foundries to boost the industrial sector of Nigeria with emphasis on the auto assembling plant sector of the economy.