Youth Focused Funds

Facilitating Increased Empowerment and Support for Young Nigerians

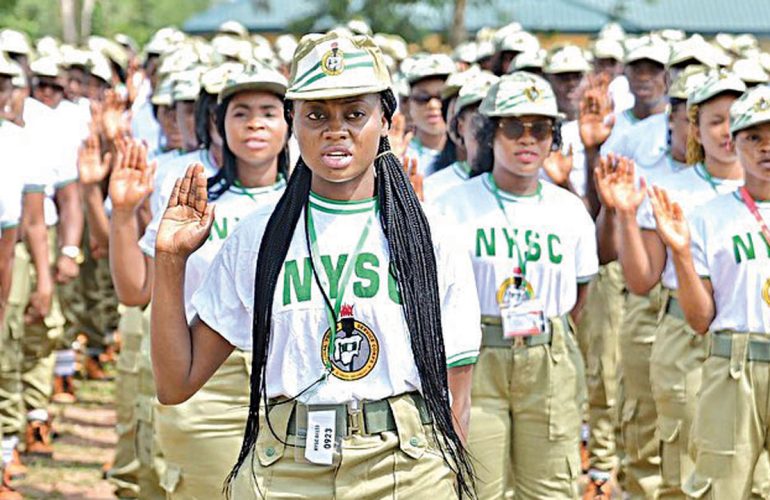

The Youth sub-directorate was established to provide low-cost funding and financial advice to the economically active but disadvantaged members of Nigerian society. They are served by the Bank through on-lending programs. This is a novel collaboration with licensed Financial institutions including Microfinance Banks (MFBs), and commercial banks offering both traditional and Non-interest banking products to our large and diverse customer base. This has enabled the Directorate to catalyse and increase its impact and support to the Nigerian youth.

Through the youth sub-directorate, the Bank undertakes significant efforts aimed at addressing identified economic gaps affecting the country’s youth. Our youth-focused funds and business advisory are specific interventions designed to address the challenges of entrepreneurship development, youth unemployment, growth and development, business resuscitation, job creation, and poverty alleviation.

WHY CHOOSE BOI

We Create Convenient and Valuable Opportunities for Businesses in Nigeria

Youth Focused Products

We empower the Nigerian youth through low-cost funding and financial advice

BRAVE Women Project

At Bank of Industry, we believe in the opportunities the fashion industry presents in contributing significantly

Graduate Entrepreneurship Fund (GEF)

The Graduate Entrepreneurship Fund (GEF) scheme is the Bank’s first youth programme which was launched in October 2015

Government Enterprise And Empowerment Programme (GEEP)

The Government Enterprise and Empowerment Programme (GEEP) Fund was established by the Federal Government

MTN Foundation YEDP Fund

Accessible by members of the MTNF Alumni community. The Fund aims to build the capacity of 75 members

The Tertiary Institutions Entrepreneurship Scheme (TIES)

This scheme is designed and implemented to provide Financial support to all Nigerian graduates

Youth Entrepreneurship Support Programme (YES-P)

The Youth Entrepreneurship Support (YES) Programme is BOI’s effort at addressing the worrisome phenomenon

Youth Ignite Programme

The scheme will provide the young aspiring entrepreneurs operating micro-businesses the opportunity to access funds

Youth Upscaling Fund

Accessible by entrepreneurs aged 18 – 40 years with a minimum educational qualification of OND

IMPACT

We leverage technology, strategic partnerships and intermediary channels to deliver specific intervention and low-interest loan products to Nigeria’s enterprising youth population across all available sectors (informal, semi-formal and formal sectors).

Achanwamba Farms is an enterprise located in Owerrinta, Abia State and has its primary business as fish farming and fish feed production, sales of catfish and fish feed. They began their banking relationship through the Graduate Entrepreneurship Fund in 2016 and accessed their first loan facility to procure equipment and raw material for a fish farming business. The company has grown to an annual turnover of 24,000kg of fish. In 2021, the company liquidated their first loan facility and already has another loan facility running, which is for the expansion of the fish farm and fish feed production and it is expected to grow its annual turnover to 36,000kg of fish. The company has contributed to its community through the employment of indigenes and also the development of its environment.

This is a paint production company located in Otukpo, Benue State. The business is a beneficiary of the GEF scheme and produces different classes of paints some of which are Emulsion, Satin and Tex coat. The business was previously into small-scale manual production of paints. It traditionally produced a maximum of 100 buckets of 25Litres paint in a month. However, since the intervention of the Bank of industry the business was able to acquire an electronic motor, mixer, reactor and chemicals, the company is now able to produce 140 buckets of 25 litres of paint in a single day. Furthermore, this expansion is accompanied by an increase in staff strength as more manpower became necessary to match the improved capacity of the company.

FAQs

Frequently Asked Questions on Enterprise Products

Browse through our repository of answers to our frequently asked questions. Should you not find a conclusive answer to any of your questions, please book a consult by filling out the form on the right and we will get in touch with you.

Loans can be applied for either physically or online. For physical application, customers are advised to apply either at any of the BOI branch offices that is closest to them or at the headquarters (for loan applications that are N1bn and above). Customers who want to apply online can do so by applying on the bank’s website or by clicking the link www.boi.ng/apply to apply.

There are criteria that must be met for a project to be eligible for financing. These include:

- Businesses must be registered with the Corporate Affairs Commission (CAC)

- Businesses must have their audited financial statements (if existing)

There is a checklist that can guide loan applicants. The list of requirements to apply for a loan can be found on the Bank’s website. Please click here for Pre and Post Approval documentation requirements. (LE checklist link)

Yes, there is a checklist that can guide loan applicants. The list of requirements to apply for a loan can be found on the Bank’s website. Please click here for Pre and Post Approval documentation requirements.

All loan applications are submitted at the respective groups within the head office. However, it is IMPORTANT TO NOTE that processing of the loan application does not commence until all documents stated in the checklist are provided. (Our Locations)

BOOK A CONSULT

Get Started

We believe that collaboration is necessary to achieve our goal of economic transformation goal, We want to Work with you to achieve a sustainable growth, lets begin your success journey.