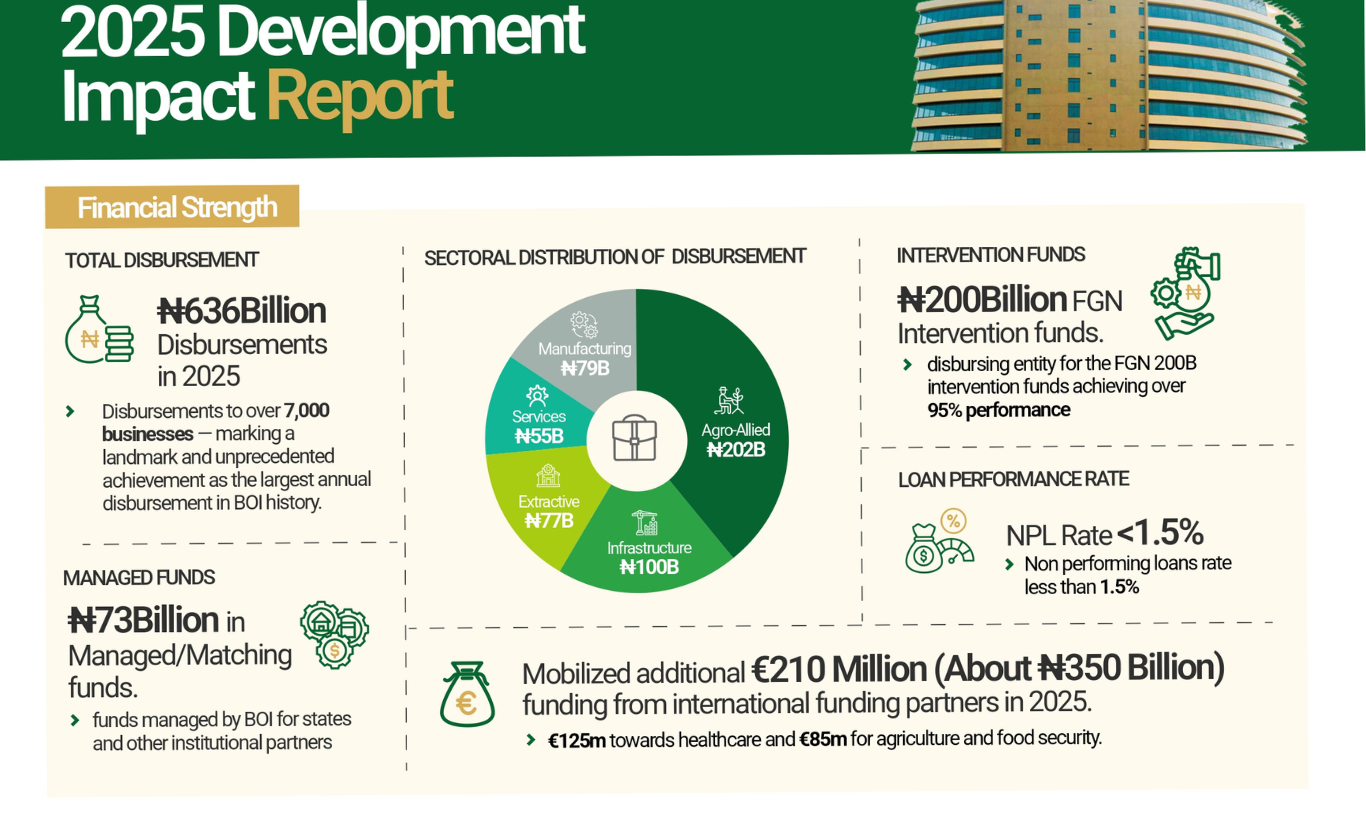

Transforming Nigeria's Industrial Sector

We provide advisory and financial assistance for the establishment of large, medium, and small enterprises and rehabilitation of ailing ones.

"The financial sector’s role is crucial in facilitating the building of a vibrant industrial sector”

— DR. OLASUPO OLUSI

MANAGING DIRECTOR/CEO OF

BANK OF INDUSTRY

The Bank of Industry Limited (BOI) is Nigeria's oldest, largest, and most successful Development Finance Institution (DFI).

BOI exists to facilitate the transformation of Nigeria’s industrial sector by providing financial and advisory support for establishing large, medium, and small enterprises and expanding, diversifying, rehabilitating, and modernizing existing enterprises.

The Bank continues to support growth across various sectors, including Agro and Food Processing, Creative Industries, Engineering and Technology, Healthcare and Petrochemicals, Oil and Gas, Renewable Energy, and Solid Minerals, leveraging its 33 state offices nationwide.

Who We Serve

Our Six Thematic Areas

Our Products Across Sectors

Investor Relations

News & Events

Grow your business with BOI

Access our single-digit interest loans as well as expert advisory support for your business. Click here to contact us if you have additional questions.