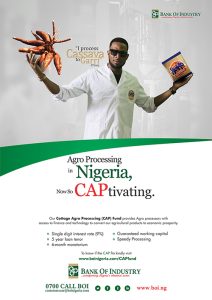

Nigeria is richly endowed with abundant agricultural products available in every state of the federation. However, limited capacity for processing and preservation, results in huge losses and wastages. In a bid to tackle this problem, BOI is establishing a Cottage Agro-Processors (CAP) Fund to support the establishment of cottage agro processing plants that will produce food products and raw materials for industries within and outside the Staple Crop Processing Zones (SCPZs) across Nigeria.

Nigeria is richly endowed with abundant agricultural products available in every state of the federation. However, limited capacity for processing and preservation, results in huge losses and wastages. In a bid to tackle this problem, BOI is establishing a Cottage Agro-Processors (CAP) Fund to support the establishment of cottage agro processing plants that will produce food products and raw materials for industries within and outside the Staple Crop Processing Zones (SCPZs) across Nigeria.

The fund is targeted at small-and medium-scale industries at the low-technology, labour-intensive end of the spectrum and is expected to finance about 1000 projects at nine percent interest charges, with total management fees of 1%,a tenor of five (5) years with a moratorium of six (6) months. The Fund will also help in creating a total of 20,000 direct and indirect jobs. The Fund will be accessed by Limited Liability Companies, Enterprises and Cooperative Societies engaged in the processing of agricultural products either into finished food products or raw materials for industry or for the export market. The products include; Cassava, Oil Palm, Rice Paddy, Groundnut, Yam, Maize, Sorghum, Aquaculture, Livestock, Cocoa, Shea nut, Plantain, Cashew, Tomato and all their individual derivatives.

WHY APPLY FOR BOI CAP FUND?

- Agriculture is the mainstay of the Nigerian economy

- The sector enjoys the support of the federal government

- Create jobs and ensure wealth distribution

- Single digit interest rate (9%)

- 5 year loan tenor

- 6-month moratorium

- Guaranteed working capital

- Speedy processing

WHO IS THE FUND FOR?

The fund is designed to benefit Limited Liability Companies, enterprises and Cooperative societies engaged in the processing of Agricultural produce into food products and/or raw materials, either for industry use or for export.

CHECKLIST OF REQUIREMENTS FOR BOI LOAN APPLICATION

- Formal Application

- Photocopy of Certificate of Registration (Form CAC/BN/A1).

- Business Plan

- Valuation report on existing assets prepared by an accredited BOI valuer.

- Value of equipment to be purchased from a BOI accredited supplier (including invoices).

- Source(s) and value of raw materials to be purchased expressed in units.

- Two (2) passport photographs of the Promoter (business owner)

- Photocopy of the Current Tax Clearance Certificate of the Proprietor.

- Means of Identification (i.e. International Passport or Driver’s License or National Identity Card) of the Proprietor.

- Bank Statement of the Business Enterprise for six (6) months.

- Declaration of Outstanding Liabilities to other Banks and Individuals.

- Reference letter from a recognized traditional ruler or authorized Local Government Official.

-

Provision of a minimum of two (2) External Guarantors to guarantee the loan. The Guarantors must belong to any of the following categories:

- Senior Civil Servant (not below the rank of Assistant Director).

- Bankers (not below the level of Branch Manager), with minimum of 5 years in service with the Bank (current employer).

- Lawyers (SAN).

APPLYING FOR CAP FUND:

The Bank of industry (BOI), understanding the need for entrepreneurship know-how for the agropreneurs mandates that all applicants to the CAP fund must undergo entrepreneurial training at any of the existing accredited Business Development Service Providers (BDSP) and apply through this Organisations who have been well briefed on all BOI requirements in order increases your chances and speed up the application process.

dustry (BOI) has secured a $100 million line of credit from the African Development Bank (AFDB) to actualise its development financing objectives and intervention, especially for Small and Medium Enterprises (SMEs).

dustry (BOI) has secured a $100 million line of credit from the African Development Bank (AFDB) to actualise its development financing objectives and intervention, especially for Small and Medium Enterprises (SMEs).