The renowned international rating agency, Fitch, has assigned Bank of Industry (BoI) a national long-term rating of AA+(nga) and national short-term rating of F1+(nga) as the national ratings reflect the bank’s creditworthiness relative to the best credits in Nigeria.

Fitch’s rating is coming on the heels of a domestic credit rating of A- secured by the BoI from a leading Nigerian credit rating agency, Agusto & Co, affirming that the financial institution remains in good financial condition and has a strong capacity to repay obligations on a timely basis.

At a long-term Issuer Default Rating (IDR) of BB- as well as a negative outlook and a short-term IDR of B, Fitch has advocated for increased support for the BoI by the federal government in order to improve the bank’s lending capacity and aid the realisation of its objective.

According to Fitch, BoI’s long-term IDR is at its Support Rating Floor (SRF) of BB-, which considers Nigeria’s ability to provide such support in a timely manner as and at when it is required, as indicated by Nigeria’s long-term foreign currency IDR of BB-.

However, Fitch noted, “The ratings could also be downgraded in the event of material change in the government ownership and/or any change in the bank’s policy role. An upgrade of the Nigerian sovereign would not necessarily lead to an upgrade of the BoI’s IDRs. The BoI’s national ratings are sensitive to any change in Fitch’s opinion of the BoI’s creditworthiness relative to the best credits in Nigeria,” Fitch added.

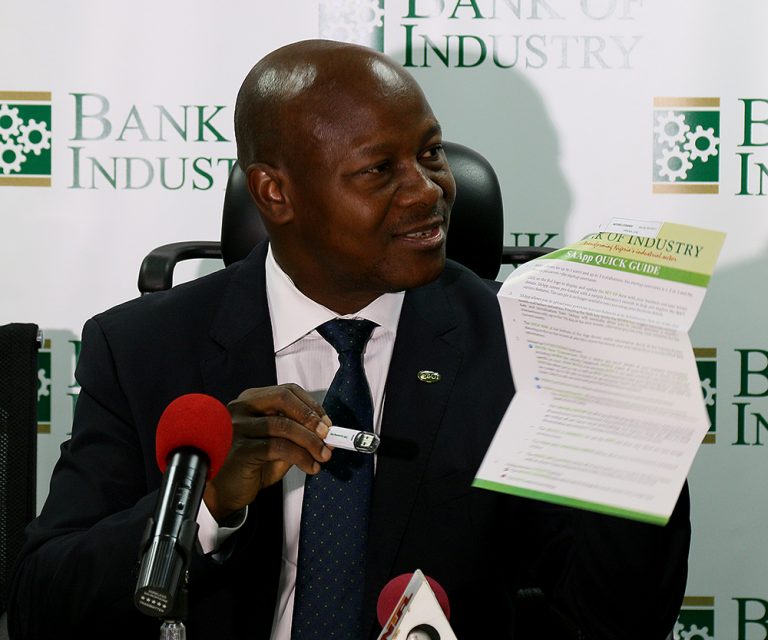

Speaking on the rating, the managing director of the BoI, Rasheed Olaoluwa, said, “The positive rating is an endorsement of our ongoing transformation project at the BoI and an affirmation of our strategic intent of adopting global best practices in all aspects of our operations.

It further affirms an improvement in Agusto’s rating of the development finance institution.”

According to the Managing Director, “We are determined to make increasing impact in our focus sectors and to continue to set the pace as Nigeria’s leading development bank.

In Kano city, Rumbu Sacks Nigeria Limited has said it will increase its workforce to 2000 Nigerians with its ongoing expansion project. The woven sacks and mat company owned by former speaker of the house of representative turned entrepreneur, Alhaji Ibrahim Salisu Buhari is a beneficiary of various loans facility from the Bank of Industry (BoI) targeted to stimulate businesses in Kano State. The company which started in year 2000 with 30 staff has grown to become Nigeria’s leading manufacturer and exporter of mats, sacks and allied products within the West Africa coast. Transacting with the bank for about a decade, Buhari’s Rumbu has maintain a perfect records on prompt payments of the loan. Buhari’s company was listed in the BoI Hall of Fame for prompt payment of facilities and massive jobs creation in the state. “It has taken 6 facilities from the Bank since 2005 and successfully repaid while its turnover increased from N130.0 million from 2002 to N1.731 billion in 2013.” Buhari praised the single digit interest rate given to manufacturers, noting that it is not only convenient, but also easy to repay. He said the company grew from scratch 15 years ago to become the biggest producer of woven sacks and mats in the country “BOI improved our operations to the extent that we have been able to achieve an evolution of our production process from manual to advanced automation. Similarly, our company has been able to increase its workers from 231 in 2001 to 1,163 to date in direct and indirect employees “By the time we finish the ongoing expansion, we will increase our mat machines from 200 to 250 and total strength of 2,000 Nigerians,” he stated. According to him “Rumbu Sacks is the first and the only mat production company in Africa to acquire, install and fully operate the computerised Jacquard weaving machine. With the machines that were acquired with the loan, production is now easier and inch-perfect.” Passionate about engaging young people in the country, Buhari said the company is 100percent operated by Nigerians. “we have had zero direct involvement of any expatriate staff from outside. We are all Nigerians working at Rumbu, if other big entrepreneurs emulate this, unemployment in the country will be reduce drastically.

In Kano city, Rumbu Sacks Nigeria Limited has said it will increase its workforce to 2000 Nigerians with its ongoing expansion project. The woven sacks and mat company owned by former speaker of the house of representative turned entrepreneur, Alhaji Ibrahim Salisu Buhari is a beneficiary of various loans facility from the Bank of Industry (BoI) targeted to stimulate businesses in Kano State. The company which started in year 2000 with 30 staff has grown to become Nigeria’s leading manufacturer and exporter of mats, sacks and allied products within the West Africa coast. Transacting with the bank for about a decade, Buhari’s Rumbu has maintain a perfect records on prompt payments of the loan. Buhari’s company was listed in the BoI Hall of Fame for prompt payment of facilities and massive jobs creation in the state. “It has taken 6 facilities from the Bank since 2005 and successfully repaid while its turnover increased from N130.0 million from 2002 to N1.731 billion in 2013.” Buhari praised the single digit interest rate given to manufacturers, noting that it is not only convenient, but also easy to repay. He said the company grew from scratch 15 years ago to become the biggest producer of woven sacks and mats in the country “BOI improved our operations to the extent that we have been able to achieve an evolution of our production process from manual to advanced automation. Similarly, our company has been able to increase its workers from 231 in 2001 to 1,163 to date in direct and indirect employees “By the time we finish the ongoing expansion, we will increase our mat machines from 200 to 250 and total strength of 2,000 Nigerians,” he stated. According to him “Rumbu Sacks is the first and the only mat production company in Africa to acquire, install and fully operate the computerised Jacquard weaving machine. With the machines that were acquired with the loan, production is now easier and inch-perfect.” Passionate about engaging young people in the country, Buhari said the company is 100percent operated by Nigerians. “we have had zero direct involvement of any expatriate staff from outside. We are all Nigerians working at Rumbu, if other big entrepreneurs emulate this, unemployment in the country will be reduce drastically.